1Likes 1Likes

|

|

27 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2007

Location: London

Posts: 621

|

|

|

Crossing the EU with no MOT/road tax/insurance

Hi all.

I left the UK with my UK registered car in February 2007. I drove across North Africa, The Middle East, South Asia and then Thailand etc. Later in 2008 I will be returning home. As can be imagined, the UK MOT and road tax have long since expired and you can't get UK MOT, Road Tax or insurance outside the UK. DVLA told me I had to declare the car exported - which I have done. While I am outside the EU, it's not a problem but as soon as I set tyre in the EU - which I will have to do to drive across it to get back to the UK - I will be committing an offence by driving a car that is registered in an EU member state but which doesn't have a current MOT, road tax and insurance in that state. Just like a German would be doing if he drove his German-registered car in the UK without current German MOT, road tax and insurance. DVLA tell me it will be up to the Polish/German/French police to catch me as I am passing through those countries - if they don't, it isn't an offence in the UK. So - someone on this forum must have faced something like this on various long-term overland trips - do you have any experience of the likelihood of problems with the authorities in each of these countries?

As soon as I get the car back to the UK, I will need to get it transported from the ferry port, which shouldn't be a problem. Then I will get it MOTd and taxed and get it re-registered with DVLA.

|

27 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2007

Location: Saudi Arabia

Posts: 173

|

|

If you have declared your car exported from the UK surely it's no longer registered. Now you have the problem of registration because if you get stopped or at customs they are going to ask where it is registered since you exported it.

It might be worth getting the car test done in the country you are in, that way you have a document that says your car is road worthy and you should be able to get insurance. AXA might have an office where you are eg I am in Saudi and have ins through AXA for the middle east and when I ride home they will arrange cover for the rest of my trip to UK. I don't think road tax is a problem when you transit through a country.

My bike will be deregistered and off the Saudi computer but I will have export plates.

I'm not sure it was a good move to declare your car exported as now it doesn't have a home.

Cheers

Ian

|

27 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Dec 2007

Location: france

Posts: 109

|

|

|

just my input.

Hello, what's done is done - declaring your car exported.

Ian does have a point about having a cover letter from an insurance group.

Axa is a popular insurer in France. I'm sure if you had a quick visit to an agent, as soon as you arrive in the EU, a quick check over and then back to the agent for the document, its the best decision for travel through EU countries. You're looking at about 200€ tops for the CT (Controle Technique) and the 1-2 month insurance. It's the wisest choice, considering you're a danger on the road without insurance for yourself and for others. Good luck with your trip.

European Sales Contact

European Community European CommunityTelephone : ++ 33 1 55 92 40 05 Fax: ++ 33 1 55 92 40 58 E-mail: sales@axa-assistance.com AXA Assistance Links

Last edited by ta-all-the-way; 27 Jan 2008 at 17:11.

|

27 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Dec 2006

Location: Moscow

Posts: 1,117

|

|

|

This is (yet again) DVLA being less than helpful towards anyone daring to step outside their customer model of domesticity at home and regularly paying their money over to Government departments and Agencies.

They really should not be so interested in Revunue raising matters such as Road Tax and Penalties, and start solving problems of their own creation.

My thoughts (and these are just that, I am no Lawyer but have spent a lifetime interpreting other UK Law and Regulations) :-

Registration. It is probably deregistered having been declared Exported. I would like to think they could reactivate the registration even though the vehicle is not yet on the UK public roads. The problem could be proof of its continued existance until they (or their Inspectors) actually see it - as can happen if transferring a Cherished Number from a vehicle not currently 'on the road' and without MOT, insurance etc.

MOT. Cannot be done outside UK. There are technical 'check up' tests in some other countries but DVLA are not interested in them. You can drive/ride legally without Road Tax and MOTin the UK if going to a pre-booked test. There is nothing that says this must be close by. So you could telephone from (say) Dover to book a test in (say) Scotland, and drive there quite legally on this count.

Some countries (even in EU) do not even have tests for some classes of vehicles eg. motorbikes are never tested in France. This implies other EU countries have no interest in UK MOT certificates - despite what DVLA might like you to believe

Insurance. This is a 'private' contract between you and the Insurer resulting from what you both agree, but they must be fully aware of everything. A valid MOT is not a requirement 'per se', but they could decline a claim if it is something that resulted from a mechanical defect. eg lack of MOT should have no bearing on a theft claim.

Whether they are flexible enough to accommodate your situation I do not know, but a good Broker would be able to sort it out. Only real problem I forsee is the lack of a valid Registration and the submitting of signed originals of declarations and payment from afar. Lack of MOT, for travelling to get one should be declared to the Insurer, but this cannot be a problem for this use.

Road Tax. This is (was?) only payable if the vehicle was being driven on the UK public roads. However I notice DVLA quietly changed their website a few months ago which previously said it was not payable if the vehicle was outside UK - now says it must be paid. I do not know if this is an actual change in the Law or just them trying to collect more money for the Government. Anyway you cannot buy this until you have a valid MOT, only capable of being obtained within the UK. This implies UK Road Tax is not payable for using the vehicle outside the UK and as other countries are not interested in MOTs they are equally not interested in UK Road Tax. Despite what the DVLA would like you to believe.

Personally, I would like DVLA to allow an annual SORN declaration to include vehicles not intended to be permanently abroad even though on extended trips - afterall they are not being used on the UK roads. But I doubt they would accept this if they knew the truth.

What I wonder is, as you have declared the vehicle as Exported you presumably sent back the entire V5. How then, have you been travelling since? You clearly have crossed numberous borders and my experience is that Registration Documents must be produced to enter, and sometimes to leave, countries beyond the EU - sometimes even within, particularly if it is a Schengen area border.

Last edited by Tony P; 27 Jan 2008 at 17:13.

|

29 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2006

Location: Bribie Island Australia

Posts: 678

|

|

|

In my experience last year road (7 months in Europe) border crossings are almost all unmanned now in the EU and within Schengen countries. If manned they are interested only in people in the vehicle.

The only border actually controlled seems to be the UK, which seem more interested in illegal arrivals than anything as mundane as rego and MOT.

Remove the tax disc to avoid an obvious out of date query from a copper, pre book an MOT test as sugested above.

|

29 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Aug 2001

Location: Vancouver, BC - now at large in the world

Posts: 411

|

|

|

You'll get as far as Turkey before insurance is an issue again. You need it to enter. If you come from Iran, you'll have to get to Dogbiscuit somehow before they will let you in. When I came back from Syria, I actually got someone at the border to ride into town and buy me insurance. I wasn't going to leave the bike at the border, naturally. It cost me a day.

|

29 Jan 2008

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jul 2002

Location: Sydney, NSW, Australia

Posts: 1,362

|

|

|

Here the rego people were quite nice in comparision -

Get an inspection by someone with govt recognition [if I could not get that .. then I'd get something ! Anything is better than nothing .. and put an explantion letter with it] - have it translated into english .. send that to them with the fee (they take internet money things) .. and pay the australian insurance (more internet money) and they'll let me have registration (post it out to me .. long wait) .. even though I'm not in the country ..

I'd think you have done the wrong thing by 'exporting it' .. you are travelling and will return so need your local registration and insurance. You need this to be able to travel in another country as they require your vehicle to be registered (even if not registered in that county). If the govt department is not cooperating .. a lettter to your local represtiative (govt or oposition) may get things fixed .. for the next trip. I'd suggest if this is a problem for UK residents that all you UK residents write in. And at the next HU UK meeting you have a petition ready .. and get every one to sign .. small though you may be in total numbers. Better if every one writes in using personal letters.

__________________

---

Regards Frank Warner

motorcycles BMW R80 G/S 1981, BMW K11LT 1993, BMW K75 G/S

|

29 Jan 2008

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: Whangarei, NZ

Posts: 2,214

|

|

|

The only issue is insurance. If you have an accident, however minor without it you will be in deep trouble.

Try going to an AA office in the first EU country you come to and see whether they will sell you a Green Card insurance. Worked for me in Turkey, Italy and Germany, but the former where 20 years ago. Things change.

|

30 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2007

Location: London

Posts: 621

|

|

|

Hi all

Thanks for your very helpful information (especially Tony P - that epistle must have taken you some time!)

I don't think I explained fully or accurately what had happened. What I actually did was SORNd the car at the end of February 2007 when I left Italy and entered Tunisia. Recently I called DVLA to ask about this. Once they found out the car and I were outside the UK on an overland trip, they told me I shouldn't have SORNd it but should have declared the car exported - which I have to do before the SORN expires at the end of February. Thus I haven't yet declared the car exported - I was merely about to. Re the V5 registration document - I SORNd the car online and DVLA have told me I can declare the car exported online as well - thus I still have the V5 and can still keep it even after I declare the car exported. DVLA did also tell me I should not have SORNd the car but continued to pay Road Tax on it if it wasn't off the road in the UK but was on the road OUTSIDE the UK - even if not in an EU country. Curiously, however, they confirmed that I hadn't committed an offence by SORNing it but will have done so if I don't declare it as exported before the present SORN expires at end Feb 2008.

DVLA also told me that once I get the car back into the UK, to 'resurrect' it on their records I will need to a) get it MOT'd b) show the certificate of Export (which DVLA will post to my home address once the car is declared exported) c) get it UK insured d) proof of ID e) a cheque for a new road tax disc and f) a completed v55/5 re-import certificate.

I am not bothered particularly about the MOT or Road Tax issue, but the insurance IS a headache...getting a couple of hundred euros fixed penalty fine isn't the end of the world, but crashing into someone and maiming them/their vehicle when I don't have insurance would be. But from this discussion thread, getting insurance from someone like AXA as soon as I reach the EU shouldn't be a problem.

In the light of this fresh information, any further ideas?

Mark

|

30 Jan 2008

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Nov 2006

Location: gone for a spin

Posts: 269

|

|

|

doh!

i had a similar kind of problem whilst working in the EU for 6yrs. i kept my insurance running with bennets who will only pay 90% of any claim whilst i did'nt have an mot.(which i did'nt) i was in france and did'nt need it but also travelled in other EU countries and was never asked for it.

as for the DVLA i notified them that i was travelling around other countries and would be back to britain in the future, they said i would need to export the vehicle as it's not in britain. i kindly replied that i am travelling and will not be staying in any country for any length of time so therefore will NOT register the vehicle as exported because it is'nt and will NOT buy tax as i'm not on any british road.= NO PROBLEMS whatsoever. after 6yrs i re-taxed said bike no problem.

if i was you i'd re-sorn it when it runs out and DO NOT contact the DVLA! (they will not check,they never do)you can get insurance in the uk if you like and get someone to post it out to you but DONT mention your already out of the country because they wont accept as the vehicle needs to be in the UK when you take out the policy.

or you can get green card insurance in any eu country. when entering the uk make sure you have insurance to drive there or it will cost you and your licence dearly! book in for mot at the port of entry(do this before entering the uk) look up on line for mot center and ring them then go straight there. you have your mot and insurance (preferably uk insurance) and can go straight for the tax! dont forget if you drive around without tax they wil take said vehicle until you turn up with a tax disc which you cant because you have no mot so it will get CRUSHED and you'll have a fine!

another idea is buy british insurance on-line just before entering the uk (also buy green card when your passing through europe)and go straight for mot. speak nice to the garage and they might let you use their internet to buy tax or go to nearest internet cafe and do it.

hope any of this helps.

|

31 Jan 2008

|

|

Registered Users

New on the HUBB

|

|

Join Date: Aug 2007

Location: Central France

Posts: 13

|

|

|

ignore DVLA

Kevinhancocks advice is spot on. NEVER NEVER NEVER contact the dvlc and if you do ignore their advice. If you contact them twice you will get two totally different answers. I have 3 UK registered bikes and 1 car. One bike goes back and forth to the uk from here in France 5 or 6 times a year the other never goes back to the UK. I have exported it but it is still insured with a UK company. No MOT but you will never be asked for one in France as they dont MOT bikes. The other is taxed and insured on line and i keep theMOT up to date when needed. On UK plated in rance unless you are doing something stupid the Gendarmes wil leave you alone. Never admit to speaking any French!

CHROME WONT GET YOU HOME!

|

31 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jul 2006

Location: Sheffield, UK

Posts: 226

|

|

|

As others have said, just SORN it again. How can you export it when you haven't got a fixed address in another country to export it to?

When you cross into the EU you may be asked for your V5 and insurance docs. I wasn't when I came back from Morocco into Spain, but other countries may be stricter. You could buy your insurance online and get somebody at home to forward the cover note to you. You'd probably get away with having it emailed to you and getting a printout at your end.

When you're travelling across the EU the only documents you'll be asked for will be your V5, insurance and licence. This will only be if you get stopped by the police - at borders you just drive through and show your passport if asked.

MOT and road tax are specific to the UK - don't worry about them until you get home.

|

1 Feb 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2007

Location: London

Posts: 621

|

|

|

Hi - thanks for this further advice. 1 possible problem though - this is that when I spoke to DVLA, they asked for the number plate of the car and I gave it to them and told them I was out of the UK on an overland trip. Does this mean they'll have made a note to that effect on their records? Also - if I SORN it in the UK, does that mean I'll have to pay for road tax on it? DVLA did also tell me I should not have SORNd the car but continued to pay Road Tax on it if it wasn't off the road in the UK but was on the road OUTSIDE the UK - even if not in an EU country. Also see Tony P's comment re road tax.

|

1 Feb 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

SORN it

SORN it

Having read all of the posts, the answer to your queries is already in your hands.

So, don't ever speak with the DVLA - do it all online.

The vehicle is SORNed - this means what it says; it is not on the roads of the UK, and you have not exported the vehicle permanently.

You are a very law abiding guy who wants everything to be exactly right, all of the time. Unfortunately, Govn bureaucrats, compounded by "bright young things" who have been in the job for a few months on the telephone help desk, do not have your interests at heart. I recommend that you stop worrying about what the DVLA is doing and thinking, and just look after your own interests, meeting the letter of the law at the same time.

I am afraid we have these anomalies because we are an island without a Schengen agreement to make the water crossing easier and we have a road tax system that is different from most (all?) other countries.

Recently, our illustrious parliament considered a law to register all vehicles in the UK, whether they are on road or not; it was pointed out that this would mean registering, for example, motor racing vehicles even though they are never off the track (well hardly ever!).

Imagine Rossi or Schumacher riding/driving with a number plate while in the UK for a weekend and you get the idea.

I think this was proposed as a reasonable way of dealing with the minority who ride illegal vehicles on-road.

The proposal was rejected, eventually.

ps On your specific question: SORN was brought about to allow you not to pay road tax, which is only required to be paid if the vehicle is running on the Queen's highway. That was always the law, since whenever, but it was tightened up, via the SORN system, to get people to comply.

__________________

Dave

Last edited by Walkabout; 1 Feb 2008 at 10:16.

Reason: ps added

|

1 Feb 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Dec 2006

Location: Moscow

Posts: 1,117

|

|

|

SORN is the legal alternative condition to current Road Tax, for a UK registered vehicle. One or the other should exist.

My own conclusion and own actions, based on -

1. UK Road Tax is payable by UK registered vehicles if they use UK public roads

2. Vehicles registered elsewhere do not pay (indeed cannot!) UK Road Tax to use the UK public roads - under recriprocal arrangements within the Geneva Convention. But this is only for visits of up to 6 months. Nor do many other countries have such a tax.

3. Nothing is payable for SORN - either for Tax or Admin.

4. No intention to "permanantly export" the vehicle,

is that, if I take it away for extended periods, I would SORN it as not being on UK public roads, either on departure or when a current tax expires, and renew the SORN a year later.

If they want to get 'arsey' I would demand they prosecute me (forget their fixed penalty money raising opportunities) and I will argue in any Court that my actions were reasonable and fair.

On returning, at the point of disembarkation I would telephone for a MOT test at a station convenient to my home (possibly just beyond!) and then return home to await the actual timed appointment. This use is fully legal without MOT or Tax, IF YOU HAVE AN APPOINTMENT. There is nothing that says the test must be close to the point of disembarkation or within a short time.

I fully agree with BMW MARTIN "NEVER NEVER NEVER contact the dvlc and if you do ignore their advice" for they tell you what suits them sooner than what the Law actually says. Walkabout's second paragraph sums it up.

But this does not help Mark, who has already put his head above the parapet!

He should ensure he always has Insurance. Following that I would just do as I described above. Perhaps sending DVLA a Letter of my intentions (to which they cannot reply, not having an address until I am home!) which would further strengthen my arguments in a Court. Even if some CPS representative comes up with some obscure legislation, it would be a very, very perverse Magistrate to rule I had sought to defraud or acted unreasonably and impose a penalty.

Good luck and enjoy the rest of your trip. Tony.

Edit. - Incidentially, I got so fed up with people asking what my Tax Disc was, in Russia last year, that I took it off. One less thing to lose to the souvenir hunters!!

Last edited by Tony P; 1 Feb 2008 at 12:57.

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

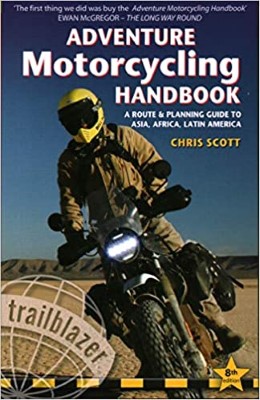

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|