36Likes 36Likes

|

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jun 2000

Location: GOC

Posts: 3,364

|

|

Quote:

Originally Posted by Nath

Woops, I made a little mistake there. I described Colebatch as a banker, but it seems I the word I was actually looking for was... Wanker?

Go back to drinking champagne with Giles and Tarquin and stop being a troll  |

I thought about deleting your post, quoted above, because of it's offensive nature. I haven't because Walter is able to counter your (chemically induced?) rantings in an appropriate way. Your post also helps to show how measured and mature your utterances are(n't).

I've met Walter. I think he's a good bloke. Have you? Please also read all the good and current information he submits here and on ADVrider. I sent him a couple of PMs the other day regarding a Siberian question I had. He replied virtually by return. Excellent, in my book.

How are you helping to make the (HUBB) world a better place?

Please don't EVER misquote people.  Thanks.

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

|

The responsibility may lie with King Henry VIII

For those who are still hanging in there and considering the morality and ethics of banking, the problem may go back as far as 1545:-

Usury - Wikipedia, the free encyclopedia

Within the UK it has been reported that Islamic banks are growing in number.

I don't see any Christian banks on the high streets, to date.

Incidentally, there is a brief reference at the end of that wiki article to micro-financing.

__________________

Dave

|

25 Jan 2013

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Feb 2011

Location: Chiang Mai, Thailand

Posts: 193

|

|

|

Sharia(h) lending

. . . is reasonably large and growing.

HSBC's Amanah has been around for some time.

"Christian" lending is somewhat meaningless as there are no prohibitions on lending in the New Testament.

However, if you take Shakespeare seriously . . . "neither a borrower nor a lender be" carry on before credit and sophisticated finance and . . . enjoy the 15th century. "More gruel, Master."

Banks and bankers will follow the money . . .

Now as for the potential pitfalls and perils of fiat money, or the possible built-in instabilities of capitalism . . . economists continue to debate those and have for at least 150 years.

__________________

Orange, it's the new black.

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

Quote:

Originally Posted by Genghis9021

. . . is reasonably large and growing.

HSBC's Amanah has been around for some time.

"Christian" lending is somewhat meaningless as there are no prohibitions on lending in the New Testament.

However, if you take Shakespeare seriously . . . "neither a borrower nor a lender be" carry on before credit and sophisticated finance and . . . enjoy the 15th century. "More gruel, Master."

Banks and bankers will follow the money . . .

Now as for the potential pitfalls and perils of fiat money, or the possible built-in instabilities of capitalism . . . economists continue to debate those and have for at least 150 years.

|

Well, again relating to the UK, it is pretty much a non-Christian, secular society nowadays and I was merely pointing out one important origin of western methods of finance, which included Christian banning of the payment of interest.

It is very likely that such Usury principles relate to the old testament which contains the foundations of Islam, Judism and Christianity, hence their common approach to their historic principles of lending.

Lets see what the new Archbishop of Canterbury has to say about this when he is in place later this year (he is an ex-business man).

"Banks and bankers will follow the money" . . . and, therefore, require a lot of regulation in order to bend them to the greater good rather than their own selfish, short term interests.

Through history, no fiat currency has survived; the latest example to test us is the Euro which now demands the full political integration of those countries which are members of that currency. We shall see how that pans out, but I suspect it will all end in tears.

Interestingly, to me anyway, some towns and cities in the UK have introduced local currencies for use in local commerce; arguably a return to the middle ages.

Bristol Pound - Our City. Our Money

__________________

Dave

Last edited by Walkabout; 25 Jan 2013 at 12:23.

Reason: Bristol pound added

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

|

And ................

................. Max Keiser has just appeared on UK TV to say that this country is heading into a financial crisis (yep, another one).

His basic premise today is that the bond markets have driven out all productive activity and interest rates have nowhere to go but up, and up.

We can still devalue our currency, unlike those countries who signed up for the Euro; in fact, such devaluing is happening now on the markets - just look at the Euro/£ exchange rate over the last week or so.

He also made mention of the gold standard and how European governments so distrust each other that they are buying up gold and silver to stock their own vaults; all this against the day that the Euro splits asunder.

If you are interested in what he has to say about global finance he runs a show on Russia Today and he is all over youtube.

We are all pawns on this particular chessboard.

__________________

Dave

|

25 Jan 2013

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Feb 2011

Location: Chiang Mai, Thailand

Posts: 193

|

|

|

A joke . . .

there's a reasonably popular joke in investment banking circles over the past 5+ years.

"What's the world's largest hedge fund ?"

The UK.

"What's the difference between a pigeon and an investment banker ?"

The pigeon can still leave a deposit on a Ferrari.

The bond markets have, ahem, brought discipline to govts for a long time. Napoleon felt their wrath, too.

Marc Faber, aka 'Dr Doom' lives here in Chiang Mai. His prognostications have been VERY negative for some time and especially so recently.

__________________

Orange, it's the new black.

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Feb 2008

Location: Washington, DC

Posts: 1,377

|

|

|

Somehow I've overlooked this thread until now, how fun! I have to say that the OP's prejudices are ill-informed and offensive...how would his rant have gone over if he had replaced "banker" with "[pick your least favorite race/nationality/religion]"? How is it any different? One of my favorite sayings applies here: "I hate intolerant people!!".

And for once I'll have to disagree with Colebatch: everyone knows that the key to a high quality of life is not bankers, but lawyers!

|

28 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

|

To take a loan or not, that is the question

Quote:

Originally Posted by Genghis9021

However, if you take Shakespeare seriously . . . "neither a borrower nor a lender be" carry on before credit and sophisticated finance and . . . enjoy the 15th century. "More gruel, Master."

|

Naturally, Shakespeare had a lot of points to make about society, the condition of mankind and the like, back in those days which I can only assume were based on the principles of Usury.

I imagine (not being around at that time) that he highlighted a couple of extremes within "neither a borrower nor a lender be" in order to generate thought among his audience.

In this day and age I would expect people to live within their means; in simple terms, certainly take out a loan but only on the basis that you can afford the terms and conditions and can repay the loan (+ the interest of course, if you have not used an Islamic bank).

__________________

Dave

|

28 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

|

A good idea? - Domestic issue

There is another "live now, pay later" scheme here in the UK which is related to the provision and use of household energy.

This has come into being because people are not investing their hard earned income into capital expenditure on insulating their property (and other similar energy saving schemes but I am no expert in what they are).

So, what the Government want to encourage is that householders install the energy saving systems and pay for it via their future energy bills; in theory the bill for energy usage is reduced by the installation so the customer does not "notice" the portion of their bill which is contracted to repay the capital expenditure - i.e. there is no up-front payment.

Paying off the scheme will probably be over 20-25 years.

A "catch" in this, is that when a property is sold, the repayments "stay with the electricity meter". In other words a future purchaser of such a property inherits the liability to continue to pay for the installation; that's neat.

No one has explained in this news item if the banks are involved in the financing/administration of this scheme, or if it is executed via some government agency/quango.

__________________

Dave

|

28 Jan 2013

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Jul 2008

Location: London

Posts: 405

|

|

Someone up above says "I would like to think that this thread will be of some use to the youthful individuals among us - including those who come to view this in the future....."

Well, by the time I've read this far, I've lost track of who said what to whom about what in response to which posting.

But it's certainly entertaining, what the bar's for, so here goes....

Mine's a pint of sarsaparilla

While agreeing that there are good and bad in all professions, it seems to me that the de-regulation of the finance industry in the 70s/80s allowed those bankers with greed as their main motivation to completely swamp the honest professionalism of the rest. The UK government at the time were warned of exactly this possibility, but warning Maggie Thatcher of 'unintended consequences' was not fashionable in any part of society and was rumoured to be a hanging offence. It's not for nothing that the moniker "SWMBO" entered just about every language on earth.

(Yes, I'll be at Trafalgar Square the first Saturday).

It became so bad that a whole country's complete banking system collapsed, a timely reminder on today's BBC news:

BBC News - Icesave: Icelandic government wins compensation ruling

"Icesave, run by the Icelandic Landsbanki, collapsed in 2008 along with all of Iceland's banking system."

I don't think any western country has ever had a complete collapse of, say, health care, energy distribution, education, police etc.

As far as I know, no other profession was stripped of so much basic regulation, checks and balances, as the finance industry. And human nature being what it is, we see the results today.

Yes, 'regulators' were appointed and put in place, by the government. Expensive and useless, it's taken a few years for the FSA to lie down and die at last. Will anything else do a better job?

Probably not. Governments these days are controlled by a huge lobby industry, one of the fastest-growing industries I think. And who has the cash to pour into that industry? The bailed-out banking industry.

Like a daisy-chain?

I would ask, if the banking industry is so fundamental to the well-being of humankind within our current system of capitalism and eternal consumer growth (and I think it is), why isn't it one of the most tightly regulated industries?

Like, say, the nuclear industry, civil engineering (or any other engineering), medicine, and air transport?

It seems that no other chain-reaction misdemeanour (committed by however few people) in any other major profession has touched the lives of so many people worldwide. Perhaps the tobacco industry, and the foreign policies of large countries, get close.

Quote:

Originally Posted by Walkabout

There is another "live now, pay later" scheme here in the UK which is related to the provision and use of household energy.

No one has explained in this news item if the banks are involved in the financing/administration of this scheme, or if it is executed via some government agency/quango.

|

Don't get me started on this new pile of corruption... Oh, you already did!

"Approved Green Deal installers, such as energy companies or DIY chains, will then advise [the householders] on potential improvements, such as double-glazing, insulation or new heating systems."

So, those advisors, "energy companies" and "DIY chains" will really operate in the interests of the householders, won't they.....?

"Consumers will pay for the improvements by taking out a loan with the Green Deal Finance Company, a non-profit making organisation backed by the government."

"There is no guarantee that the eventual savings made by consumers will match the cost of the loans they take out to make the improvements."

Ladies and Gents, I give you the " Green Deal Finance Company"

Performing with the " Advisors to the Company"

Clifford Chance

Goldman Sachs International

Linklaters

Lloyds TSB

PwC

RBC

Yes Ladies and Gents, there are indeed banks of differing skills on the stage, ready to sell their advice.

This is a company making loans to householders in energy-inefficient homes, having difficulty paying their gas bills.

It's non-profit making. Why does it need such a glittering array of 'advisors'?

The advisors above?

Oh, I forgot. This has been set up by the government. So a good sprinkling of MPs, Special Advisors and senior civil servants with plenty of interests in those 6 companies, then.

Another disaster waiting to happen. No one in the whole operation is regulated to operate solely in the householder's interest.

A4E anyone? http://www.guardian.co.uk/politics/2012/feb/21/emma-harrison-a4e-nice-work

and https://en.wikipedia.org/wiki/Emma_Harrison_(entrepreneur)

Another sarsaparilla please

|

29 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

|

Banking in, and on, Iceland

Quote:

Originally Posted by McCrankpin

It became so bad that a whole country's complete banking system collapsed, a timely reminder on today's BBC news:

BBC News - Icesave: Icelandic government wins compensation ruling

"Icesave, run by the Icelandic Landsbanki, collapsed in 2008 along with all of Iceland's banking system."

I don't think any western country has ever had a complete collapse of, say, health care, energy distribution, education, police etc.

As far as I know, no other profession was stripped of so much basic regulation, checks and balances, as the finance industry. And human nature being what it is, we see the results today. |

There are a lot of well made points in the post, and one of the most interesting is the reference to what has occurred in Iceland.

As I understand this (from news coverage and the occasional documentary) the Icelandic nation decided to "get into" international investment banking - a case of chasing the asset bubble referenced elsewhere in here?

So Iceland jumped in with both feet with a lack of background in this activity/service sector, call it what you will.

I well remember at that time the full page advertisements in the UK newspapers for 2-3 Iceland based banks which offered depositors an interest rate of 12% or more; I was tempted, as I am sure many others were, to deposit some cash but this just smelt too good to be true (and we all know the ending of that motto).

But, here's the interesting bit: I believe the Icelandic case is unique (in the way explained in the news article in the link) in that their Government decided to allow the banks to fail. Contrast this with the bail-out by every (to be confirmed by someone) other nation.

On the face of it, this sounds good news but the people of Iceland may not agree: at present they are paying interest rates way above those low rates that exist at present in the UK and elsewhere; in other words, their internal banking system (now they have withdrawn from the international experiment) is not trusted and cannot borrow money on the international markets at cheap rates - the net result is that families are having to pass on their debts to their children in dealing with mortgages that extend way past the lifespan of any single individual.

Perhaps a native of Iceland can add value to this understanding of what is happening with their country at present?

The comment within the linked article by a journalist says:-

A ruling from the little known EFTA court has put a fundamental objective of European idealists in doubt; that banks should be able to offer savings accounts to customers across Europe and that customers, in turn, should be confident that their deposits will be protected......................

In other words, it will take some time for the Iceland banks to be trusted again by anyone outside Iceland; how long though? Memories are short.

__________________

Dave

|

25 Feb 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

The issue continues (let's face it, this is not going away for many many years, if ever in the case of the UK) and now Gods' representative in England has spoken:-

Banks - ITV News

He hasn't said too much in fact, but the new Archbish is an ex-oil industry exec so he has a background of commercial activity to temper his new role:-

""The new Archbishop of Canterbury criticised Mr Osborne's banking approach Credit: Owen Humphreys/PA Wire/Press

The former oil industry executive said evidence made it clear that large, complex banks were not only "too big to fail, they are too big to manage".

However, the Chancellor defended a system based on "a small group of absolutely colossal banks" - including the mainly state-owned Royal Bank of Scotland.""

While I'm here (travelling a bit now that the daylight is returning to the northern hemis) I like this contribution and I've added a few comments, in red, since I can't remember how to do multiple quotes.

[QUOTE=McCrankpin;409605]Someone up above says "I would like to think that this thread will be of some use to the youthful individuals among us - including those who come to view this in the future....."

Well, by the time I've read this far, I've lost track of who said what to whom about what in response to which posting.

But it's certainly entertaining, what the bar's for, so here goes....

Mine's a pint of sarsaparilla  Yep, that was me and I still consider that the lessons in this thread, for all of us, are immense.

Yep, that was me and I still consider that the lessons in this thread, for all of us, are immense.

While agreeing that there are good and bad in all professions, it seems to me that the de-regulation of the finance industry in the 70s/80s allowed those bankers with greed as their main motivation to completely swamp the honest professionalism of the rest. The UK government at the time were warned of exactly this possibility, but warning Maggie Thatcher of 'unintended consequences' was not fashionable in any part of society and was rumoured to be a hanging offence. It's not for nothing that the moniker "SWMBO" entered just about every language on earth.

(Yes, I'll be at Trafalgar Square the first Saturday).

It became so bad that a whole country's complete banking system collapsed, a timely reminder on today's BBC news:

BBC News - Icesave: Icelandic government wins compensation ruling

"Icesave, run by the Icelandic Landsbanki, collapsed in 2008 along with all of Iceland's banking system."

I don't think any western country has ever had a complete collapse of, say, health care, energy distribution, education, police etc.

Precisely so, the whole sector is too central to a country's well being which is not the same thing as creating "wealth". We don't all come into contact with the police, nor even the education system for the whole of our lives and even the health system is not needed for individuals for most of their time, but banking, well it's universal in any society.

As far as I know, no other profession was stripped of so much basic regulation, checks and balances, as the finance industry. And human nature being what it is, we see the results today.

Yes, 'regulators' were appointed and put in place, by the government. Expensive and useless, it's taken a few years for the FSA to lie down and die at last. Will anything else do a better job?

Probably not. Governments these days are controlled by a huge lobby industry, one of the fastest-growing industries I think. And who has the cash to pour into that industry? The bailed-out banking industry.

Like a daisy-chain?

I would ask, if the banking industry is so fundamental to the well-being of humankind within our current system of capitalism and eternal consumer growth (and I think it is), why isn't it one of the most tightly regulated industries?

Like, say, the nuclear industry, civil engineering (or any other engineering), medicine, and air transport?

A good question and I don't have a good answer to this one; how much regulation is required and BY WHOM??

It seems that no other chain-reaction misdemeanour (committed by however few people) in any other major profession has touched the lives of so many people worldwide. Perhaps the tobacco industry, and the foreign policies of large countries, get close.

As above, it is universal. We don't all smoke and need the medics to sort us out, we don't all consume alcohol and need the medics to sort us out, nor do we all exist in a state of warfare brought about by foreign policy, but banking .....

Don't get me started on this new pile of corruption... Oh, you already did!

Yep, the UK news continues to drag the skeletons out of lots of cupboards, but that is the best reason I know not to let the bankers off the hook.

__________________

Dave

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Oct 2005

Location: Nottingham UK

Posts: 227

|

|

Quote:

Originally Posted by chris

I thought about deleting your post, quoted above, because of it's offensive nature.

...

How are you helping to make the (HUBB) world a better place?

Please don't EVER misquote people.  Thanks. |

That's fine chris, it is an insulting post, if you think it's past the line of acceptability for the hubb then delete it. It was specifically a response to colebatch after his previous post. I think it was an appropriate reply, and whilst the reasons being might be lost on everyone else, colebatch might have an idea.

I respond to questions and discussions throughout the hubb when I see that I can add a viewpoint to the discussion or share an experience. I wasn't really trying to make the hubb a 'better place' in this thread, but I didn't think I needed to either as the the description for the bar is 'no useful content required'. But I do strongly disagree with colebatch's assertion that we owe our high quality of living to bankers and should be grateful to them for it, and think it's right to challenge such views.

I don't understand what you mean about misquoting? I thought someone's post was a load of rubbish, and a neat way of expressing that appeared to be to use the quote tool but replace the text with 'a load of rubbish'. I don't see how that counts as 'misquoting' at all, since I was obviously not attempting to confuse anybody into thinking that was what was actually written, particularly since the 'quote' and response would then cease to make any sense...

|

25 Jan 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2007

Location: UK

Posts: 4,343

|

|

Quote:

Originally Posted by Nath

I respond to questions and discussions throughout the hubb when I see that I can add a viewpoint to the discussion or share an experience.

.

|

Nath,

For what it is worth I think you have done a pretty good job in this regard, over there in Honda tech for instance regarding the NC700 bike.

I have read your blog, cover to cover, and it is a good read IMO.

I would suggest that you leave the W word out of the writing style though; it doesn't add value to any particular argument or discussion.

__________________

Dave

|

25 Jan 2013

|

|

Registered Users

New on the HUBB

|

|

Join Date: Jan 2013

Posts: 6

|

|

|

It's easy to blame the Banks and Bankers for the misfortune of the last few years, but lets be totally honest...

The fraudulent, the badly managed and arrogant bankers who created the issues that led to the economic woes of so many are a small minority of those who work in the financial sector that was responsible for the stupid and dangerous practices that were allowed to go ignored, despite rumblings of discontent and warnings for many years.

The real responsibility for these failings hangs on the shoulders of the Regulators, who are universally corrupt, the Politicians, who are indolent, ignorant and corrupt, and the general public who fail to hold those in public office to proper account...remember, in a democracy the Politicians are elected/employed to run the country on our behalf, and they work for us...

Ultimately everyone has a hand in what went on, the greed of all sectors of society had a hand in it all, we all benefited in some small way from the excesses until it went wrong because the wheels fell of the cart and someone shot the horse. Government spent recklessly for decades, Greece was the worst, but they were not alone, Socialist Government have spent, spent, spent public money and religiously failed to keep some in the kitty for rainy days, and the public has failed to make them responsible for this criminal negligence.

Don't take my comments wrong, I am no lover of the bankers who operated so recklessly, I lost more than £580K from my pension as a result of their actions, and over £400K I had personally paid in over a more than 20 year period, most of my overtime, money paid for my time in the Army reserves on active service and money made from wise investments...I was to retire at 54...now it'll be more like 154, but there is no point finger waving when the responsibility goes beyond just those who acted criminally, recklessly and negligently...

Look in the mirror, you will see someone looking back who has a small level of blame...

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

| |

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

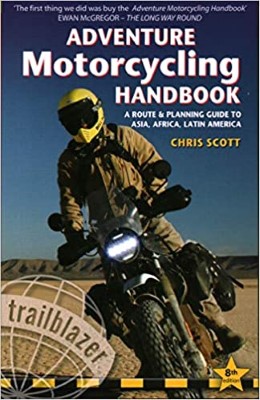

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

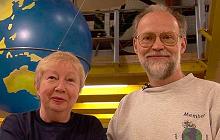

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|