1Likes 1Likes

|

16 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: Cornwall, in the far southwest of England, UK

Posts: 597

|

|

Quote:

Originally Posted by brads

They put the prices up year on year, and hope you won`t notice.

Renewing as a new customer is no issue. Once your policy has expired you are a new customer.

|

Exactly right – motor (and household) insurance policies are annual contracts.

The insurer only has the legal right to invite renewal towards the end of the contract’s 12-month term. Sometimes they don’t make the offer, of course, especially if you’ve had a bad claims experience over the course of the previous year. Actually, thinking about it, I think a motor insurer is obliged to offer terms at renewal, irrespective of your claims record, because it is a legal requirement to insure a motor vehicle whilst on the road in the UK. Of course, the insurer can hike the premium to make it very unattractive to re-new if they don’t fancy you as a risk on their books.

An insurer has the perfect defence to auto-renew, doesn’t it? - citing that because motor insurance is compulsory, they wouldn’t want to see you inadvertently breaking the law by overlooking the policy’s renewal (then pointing the finger at them for allowing the policy to lapse, resulting in you ending-up as a lawbreaker.) But despite this semi-rational excuse .. they’re still sneaky b@stards IMHO with all this auto renewal malarkey!

[Btw, for my sins, I used to work in the insurance racket! ..  ]

.

|

16 Sep 2013

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Apr 2009

Location: Dunedin, NZ

Posts: 308

|

|

|

The renewal letter / email should state that the policy will auto-renew a few days before the actual expiry date. This is to ensure they get your money from the bank on the date the policy expires. However, probably like many others, the reminder usually arrives a few weeks before I get around to searching the web for a better deal. Fortunately, I've not yet been caught out & now always tell them to cancel the auto-renewal, even if I end up renewing with them!

I work for an insurance company (non vehicle related) & the FSA (now FCA) have insisted that we stop auto-renewing policies. I'm hoping that this regulation will cascade down across all insurance policies as it's a total scam to slowly increase payments. What happened to customer loyalty where you got a discount instead?

__________________

Elaine

Striving to live the ordinary life in a non ordinary way Elaine

Striving to live the ordinary life in a non ordinary way

|

16 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Apr 2005

Location: Oxford UK

Posts: 2,120

|

|

Quote:

Originally Posted by pheonix

I work for an insurance company (non vehicle related) & the FSA (now FCA) have insisted that we stop auto-renewing policies.

|

So it's not some Euro reg brought in to compliment the continuous insurance requirement? :confused1:

|

17 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Apr 2008

Location: West Yorkshire UK

Posts: 1,785

|

|

|

They will fight it out. FCA is making a certain credit protection company buy me my next set of tyres on the good old fashioned common law principle of that if you give advice you take responsibility. The European practice of making you have what they say is right only works where the slimebag failed bookies don't squirm when it comes to paying. ( can you imagine if Ladbrokes claimed the favourite falling at the last was an act of god and therefore a reason not to pay out on the 100/1 that crossed the line first!)

The current compromise seems to be allowing them to write and phone and threaten you with going to jail if you don't, cough up.

Personally I hit the web the day their joke quote hits the door mat and ring them back with the results. I've had Hastings direct half a quote on one hand and devitts tell me to just cancel and go the second I mentioned a special offer bike sure ran. It seems to be how they want it.

Andy

|

17 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jun 2000

Location: GOC

Posts: 3,364

|

|

|

Wont ever have a problem with nutters from Bennetts again. Having dealt with them in the past when trying to cancel a policy within the cooling off period and they wanted to charge me 35 quid for flicking a switch, I refuse to deal with them. Here's the text of the letter if you ever get into the same situation. I got the entire premium refunded.

My address1

My address2

My address3

Bennetts Insurance

Pegasus House

Bakewell Road

Orton Southgate

Peterborough

PE2 6YS

10th March 2009

Ref (policy number xxxxx)

Dear Bennetts

I herewith inform you that I have submitted a complaint to the Financial Ombudsman Service. Below is a timeline of my dealings with you (known here as “Bennetts”).

1st February 2009 CB takes out motorcycle insurance online and pays by credit card £229.49 (policy number xxxxxx)

10th February 2009 I receive certificates of motor insurance, policy document, but NO key facts document from Bennetts

11th February 2009 After reading the policy document and looking at the policy excess amounts, I decide (clearly within my 14 day statutory cooling off period) that this is not the right policy for me. I post back, by Special Delivery, a letter to this effect, including the certificates of motor insurance. I have made no claim on the policy.

16th February 2009 I receive a letter dated 14th February from Bennetts saying the insurance is cancelled per 12th February. There is no mention of any fees to be paid.

5th March 2009 I receive my credit card bill. On it there is a debit of £229.49 to Bennetts and a credit of £194.46 from Bennetts. This a discrepancy of £35.03

6th March 2009 at 5.40pm I call Bennetts to complain and speak to a customer service lady. She informs me that the £35.03 is made up of £5.03 pro rata usage and a £30 admin fee. She keeps on referring to a Key Facts document, I haven’t even heard of. She doesn’t have a copy herself either and is unable to tell me where on the Bennetts website this document can be found. (I am online as I call her). If this Key Facts document exists or not, is immaterial. Legally, charges must be “fair and reasonable”. I believe them to be unfair, and I know that by any stretch of the imagination, they are wholly unreasonable.

I know a lot about IT systems. For an admin clerk to press a button on a computer screen to cancel a policy, print a letter and put it in an envelope does not cost any organisation £30 in wages/time, unless of course, this clerk is being paid £30 per minute! If they are, can I have a job please?

As you have not dealt with my complaint to my satisfaction, I have been forced to submit a complaint to the Financial Ombudsman Service. Furthermore, I will forward a copy of this correspondence to the entire printed motorcycle press and post it on every online forum I can. Customers need to be treated with fairness, not ripped off at the first opportunity.

Yours sincerely,

CB

|

17 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: Cornwall, in the far southwest of England, UK

Posts: 597

|

|

CB

The Regulator permits a ‘reasonable’ fee to cover admin charges etc, even during the Cooling-Off Period. £30 is within the definition of ‘reasonable’ nowadays. Hell, Swinton Insurance (a misnomer for ‘Swindle Insurance’ btw) were charging a whopping £50 to cover a policy cancellation at least five years ago, which even back then was considered a ‘reasonable’ amount by the glorious Regulator.

I’m not sure about this, but you might have received quicker justice if you asked for a full refund under The Distance Selling Regulations ( The Consumer Protection (Distance Selling) Regulations 2000), which provides additional rights, especially if you bought online and cancelled/returned within 7 days of purchase.

With your circumstances, if Bennetts hadn’t of co-operated, then I would have threatened to escalate the complaint to court action, or at least reporting the incident to your local Trading Standards Dept. Obviously you need to get your facts straight first though, which you clearly did.

Summary: Gone are the days when insurance brokers worked exclusively for sales and renewal commission. Typically, 10%-15% x premium for motor insurance; 15%-20% for non-motor insurance (household, personal accident, business cover etc.)

Seems that direct insurers – ‘Direct Line’ was one of the innovators in this field – could cut out the middle man (the broker) and severely undercut on price because no sales commission became payable. Brokers responded by specialising in complex risk management, offering a higher level of service to place difficult risks. Everyday standard personal lines insurance was side-lined to an extent as a result, unless the broker could charge admin fees on top of receiving commission to make deals profitable.

Insurance is a dastardly competitive business. My advice is 'do your homework', shop around hard at least every couple of years for all your insurance needs; and always stand up to the b@stards when they start dishing the sh!t.

Bah! HUMBUG!!  .

.

|

17 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jun 2000

Location: GOC

Posts: 3,364

|

|

|

Hi Keith

Indeed, they're all scumbags. I got a full refund in my situation and won't use Bennutters again. We could argue about what's reasonable and what's not, but I'd prefer to talk about wine/women/bikes so will duck out of further discussions on the topic.

CB

|

17 Sep 2013

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: Cornwall, in the far southwest of England, UK

Posts: 597

|

|

Quote:

Originally Posted by chris

.. but I'd prefer to talk about wine/women/bikes

|

Oh Yes!

I think I recognise another soul on the same wavelength as me! ..

.

.

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

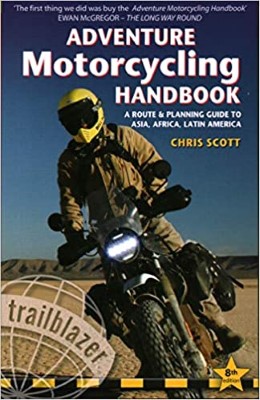

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|