13Likes 13Likes

|

|

18 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

|

Planning and setting up the financials for RTW trip

I have read numerous posts about how people get funds while travelling. At this point here is a general idea of what seems to make sense - then I'll ask about specifics.

2 bank accounts. Only one with ATM access. The idea here is that limited funds are always available at the ATM, but not ALL funds. This can be set up to enable transfer of funds from protected account to ATM account on-line.

Fake wallet - with expired credit cards and some cash and old IDs.

Hidden stash of US funds somewhere on your person and on bike.

Credit cards.

There's the structure, now to specifics. I am in Canada.

I think I have found a zero cost account at the CIBC called Simplii. Planning on opening an account there, a savings account to start dumping funds that are ONLY for travel....not bike repairs, or gear or anything else...Just travel funds.

The second account is a question mark. For a Canadian, going abroad, what is the best/lowest cost/safest and most reliable account for ATM access, or world banking. It does not have to be a Canadian bank, just one that works well.

Some people have talked about, I'm going to get the terminology wrong, but like refillable gift cards.

Any advice about getting this financial house in order would be most appreciated.

|

18 Sep 2020

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Feb 2002

Location: Wessex, UK

Posts: 2,136

|

|

|

You seem to just about have it sorted, the only comments I will make are you might have no choice about having a Canadian account as it is getting difficult to open one in other countries but I am sure there is something suitable out there.

The gift card you talk about is a pre-paid card and I like and use these, they can cost a little more to use and again you might have to find a Canadian one but they are pretty safe, you can have several and keep one with a low balance in your fake wallet.

Also a few Euros might come in handy, the US Dollar is still the most useful but you can get the occasional time when Euros are more acceptable.

Last edited by mark manley; 18 Sep 2020 at 17:42.

Reason: More info

|

19 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

Quote:

Originally Posted by Cholo

No cost account means no service.

So if you get into trouble and need help there is no friendly voice to answer your calls.

Use your local bank , the one you have used for years, make friends with the staff, say hello to the manager, tell them your plans..they might even give you their personal cell phone number.

If you pay peanuts you get monkeys !

You have saved for years and now are about to spend all your savings, so you don't want to be cheap with your finances; which are by far the most important factor, no money no food.

A good bank manager can make your problems dissapear.

I had a very good client checking into a hotel in Venice with all his family, he then realised that his credit card was missing, so he:

1. Called me international reversing the charges,(collect) which I accepted.

2. Got me to send him new cards overnight delivery. I did.

3. And even better; I found another client that happened to be staying in the same hotel,  and asked him to pick up the first clients hotel tab. To be settled when they got home.

I still get a note for Xmas from him 20 years later. |

Interesting comments. I rarely enter a bank and have not for many years. Almost everything is done via online banking or ATMs...thus I have never had a relationship with bank manager. But your points are valid. I need to find another way to accomplish the same thing - maybe by getting a POA in place for a person to help manage my financials, specifically in terms of emergency funds and dealing with problems locally. I have a BAD opinion of banks. They are not there to help or serve, but to make $$. And in too many ways their actions prove this....Thus, I will continue seeking a reliable and inexpensive or free option....but because of your comments, THANK YOU, with eyes wider open and discussing my needs with each institution.

|

19 Sep 2020

|

|

Super Moderator

Veteran HUBBer

|

|

Join Date: Jul 2007

Location: Bellingham, WA, USA

Posts: 4,029

|

|

|

You’re in a closed feedback loop regarding banks. You haven’t used a brick and mortar bank in “many years,” and yet are quite certain of your “BAD opinion” of them. FWIW, I find small, local banks can give good service, including personalized attention when the going gets rough. In my experience, they’ll do this for free—without fees—if you maintain a relatively large balance, above US$10k or so. Credit unions are a pretty good bet even with lower balances.

Having said that, I’ve had miserable experiences recently with several departments of one of the major Canadian banks, and my Canadian family tells me that’s typical.

In any case, the costs involved are relatively slight compared to the trouble the wrong bank can cause you. I’d look for service first, with costs a distant second place.

You’re also describing traveling with a single debit card, linked to a single account. I may go overboard, but I carry three (3) debit cards on a long trip—plus credit cards, plus cash. I’ve had debit cards not work for no real reason, I’ve had a couple of them swallowed by ATM machines in distant countries, and there’s always the risk of theft. I’ll rely on a single debit card if I’m traveling short-term in a place where credit cards are universally accepted, but not otherwise.

Mileage varies, etc. etc. etc.

Mark

|

19 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

Quote:

Originally Posted by markharf

You’re in a closed feedback loop regarding banks. You haven’t used a brick and mortar bank in “many years,” and yet are quite certain of your “BAD opinion” of them. FWIW, I find small, local banks can give good service, including personalized attention when the going gets rough. In my experience, they’ll do this for free—without fees—if you maintain a relatively large balance, above US$10k or so. Credit unions are a pretty good bet even with lower balances.

Having said that, I’ve had miserable experiences recently with several departments of one of the major Canadian banks, and my Canadian family tells me that’s typical.

In any case, the costs involved are relatively slight compared to the trouble the wrong bank can cause you. I’d look for service first, with costs a distant second place.

You’re also describing traveling with a single debit card, linked to a single account. I may go overboard, but I carry three (3) debit cards on a long trip—plus credit cards, plus cash. I’ve had debit cards not work for no real reason, I’ve had a couple of them swallowed by ATM machines in distant countries, and there’s always the risk of theft. I’ll rely on a single debit card if I’m traveling short-term in a place where credit cards are universally accepted, but not otherwise.

Mileage varies, etc. etc. etc.

Mark

|

I will state again....whether you agree or not....a banks purpose is to make money, not offer service. I have never had a good experience with banks...thus not entering a physical building, and having as little to do with them as possible. I'm not going to change my mind...but I do listen....and if you read my post, I am looking at how to structure, what to bring, and how to do it. Multiple debit cards is a GREAT idea. This will be part of my structure. Read my post friend. Spare cash always on my body and some hidden on the bike, mostly US, but some Euro's as well - as per another most appreciated piece of advice.

I think you may be in the US. We don't have little corner banks here. Just 4 LARGE multinationals. And I am NOT rich. Financing this trip by selling everything including my business. Managers in these banks move constantly...

I sincerely appreciate every post. Clarity of what I need to do is exactly why I posted this....and its working....Thank you. I have a ways to go, and some research......

In a month I'm going to get paid for a large job I've been working on. This will buy my bike and open my savings account with a hefty deposit. Covid has impacted my income at the moment (aside from this one project, there is no other work) and I'm reevaluating the next year and half. Selling my business and getting a regular job for a while may happen. We;ll see how things develop. As soon a Covid hit, I started to transition my business to a streaming service, which is paying off....But in these times, being flexible is a must. Even the timing of my departure is only a goal and will be evaluated as things progress.....Most people I have talked to agree that 2022 departure is probably realistic, but we'll see.

And flexibility is everything. Even with banks. Its not that I don't understand how a good relationship with a bank would be helpful.

So - I'm not just going to put my money in a place without research, talking to the people, telling them what I'm doing, and finding the best solution. One thing I am doing, is opening a FREE savings account and stuffing money into it, that is ONLY for the voyage. It may not stay there in the end....but I'll not be paying a bank just to hold my money....and before I leave there will be a good chunk of cash- and I'll decide where it ends up.

Another thing I am doing.....health. I have to get work done on my teeth. Need new glasses. And I am working out EVERY day, changed my diet, and doing everything I can to be in the best shape possible for this. And what I love is that this trip has motivated me to really get my shit together. Even without going anywhere - I'm better off. Can hardly wait to hit the road.

All the best.

|

19 Sep 2020

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jan 2016

Location: Tartu, Estonia

Posts: 1,140

|

|

Quote:

Originally Posted by krtw

This can be set up to enable transfer of funds from protected account to ATM account on-line.

|

Make sure you have a VERY good sequence of backups for if this fails. How do you access your bank account - probably via multifactor authentication? What if you lose the home SIM where you receive SMS? Authenticator app - what if you are forced to factory-reset the phone and wipe the app? Some things, for security's sake, actually cannot be reset remotely. Regaining access to your Canadian account may require you to fly to Canada and show up at a bank branch.

Quote:

|

The second account is a question mark. For a Canadian, going abroad, what is the best/lowest cost/safest and most reliable account for ATM access, or world banking. It does not have to be a Canadian bank, just one that works well.

|

Transferwise. About as cheap an international ATM/debit card as you can realistically hope for.

|

19 Sep 2020

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jan 2016

Location: Tartu, Estonia

Posts: 1,140

|

|

Quote:

Originally Posted by krtw

maybe by getting a POA in place for a person to help manage my financials, specifically in terms of emergency funds and dealing with problems locally.

|

At which point you can just go to the person who would have your POA, and instead hand them five thousand dollars in cash and say "if I contact you and say the word "Farfelnügen", please Western Union this money to whatever dodgy location I ask."

Quote:

|

I have a BAD opinion of banks. They are not there to help or serve, but to make $$.

|

That is not bad in itself. Nobody owes you a service you're not paying for.

|

19 Sep 2020

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jan 2016

Location: Tartu, Estonia

Posts: 1,140

|

|

Quote:

Originally Posted by markharf

I may go overboard, but I carry three (3) debit cards on a long trip—plus credit cards, plus cash.

|

Not overboard at all. Last big trip, I had a card for my main account, a Transferwise card, and an N26 card - and used all of them.

|

20 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

Quote:

Originally Posted by AnTyx

Not overboard at all. Last big trip, I had a card for my main account, a Transferwise card, and an N26 card - and used all of them.

|

This is the kind of information I seek....Alternative international bank cards. Thanks. Tranfewise and N26 are bookmarked.

Are there more services of this kind worth looking into?

And what do you fine folks out there think about setting up POA?

This trip is a little different....I'm not coming back home. Its a one way venture with part of the plan to seek a relatively safe and warm climate to retire in when I either finally get tired of being on the road, or I physically can't do it anymore. Having a trusted POA in Canada may be important, but I sure would appreciate comments.

|

20 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

Quote:

Originally Posted by Cholo

"..a banks purpose is to make money, not offer service."

True, of course, or did you think they were there to risk their capital for you to have a good holiday?

Do you go to a free doctor to have a heart transplant?

"Spare cash always on my body and some hidden on the bike, mostly US, but some Euro's as well . "

AHA; 10 seconds with a gun at your head and you gave me all your money, and your bike and sold me your girlfriend. Do you think crooks outside Canada are all stupid, they can't read english, they don't talk to drunk motorcyclists in bars...

You want a small branch of a huge bank!

Be nice to your mum because she will take care of your stuff

Be nice to the spares manager in your bike store because he will send you spares when you are stuck.

Be nice to your bank manager because he will get money to you when you lost your card after being out drinking. (and he needs your money to send his kids to private school,  ) nearly nothing is free.

End of free advice.

BTW there are travellers of a nationality (guess) that are SOO cheap that there are waiters in a country visited by many motorcyclists will not serve them because they never leave a tip.

The joke is: his willy is smaller than a ".......'s" tip!

And those nationals asked me, when I travelled solo, to negotiate hotel room rates for them because as soon as they produced their passports they were booted out of the hotel.

Don't be cheap, be fair, enjoy your holiday and make sure that people enjoy serving you.

Please don't take this personally I write it for all the young guys that are planning their trips |

Only I'm not young....I will start collecting my pension 2 years into my trip - and you are of course correct. I can't stop someone pulling a gun, but I can be prepared. And I've been around long enough to know how to treat people. I have done this - pull into the "hotel" section of town, where there is a line of hotels for as far as your eye can see....with all my gear on I go in and ask what the rate is....and if its too high, go to the next place....be nice, ask kindly, don't make a scene, but I have always gotten a deal....and there's nothing wrong with that.

And this ain't no holiday. Its a way of life I'm choosing. As I stated in another post, this trip is one way. I'm not coming back, and staying out there till I either die or physically can't do it....

I remember a time when banks paid you interest to keep your money in their bank. Accounts were free and the banks made money by using your balance to both invest and increase their ability to loan money. Yes, there were banking hours to deal with, 10:00 AM till 3:00 PM, no ATMs and no weekends. But there were knowledgably tellers and lines went fast. In Canada the profit margins for banks are crazy, earning BILLIONS, and then they say that's a good thing, you should be happy cause this makes a bank stable. How do they earn that money? By punishing the poor. Shit interest rates or none, transaction fees for wiping your ass...now you PAY the bank for an account - and you talk to me about service. Go to a bank and be prepared to wait cause there's only 2 tellers, who are clueless and have to wait for the one experienced person to figure out what to do.

No. Modern banks suck. I HAVE to deal with them - so will continue my research into how best to do this to be safe, pay the least, and diversify.

While getting there, I am opening a FREE savings account to stuff my travel money in - and when the time comes I'll have a better idea how best to set my finances up for this venture.

I may not agree with you - but I thank you dearly for the posts....I love how you make me think differently and get a new perspective....

I am willing to change my mind.....and in the end (give me a year) I may come to the same conclusion ......we'll see.

|

20 Sep 2020

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jan 2016

Location: Tartu, Estonia

Posts: 1,140

|

|

Quote:

Originally Posted by krtw

And what do you fine folks out there think about setting up POA?

This trip is a little different....I'm not coming back home. Its a one way venture with part of the plan to seek a relatively safe and warm climate to retire in

|

Don't expect to never, ever return to Canada. Even with a POA they might want to see that you're actually alive to start paying out your pension, otherwise the world would be full of mysteriously long-lived but elusive retired Canadians with mysteriously rich lawyers.

Quote:

|

I remember a time when banks paid you interest to keep your money in their bank.

|

You think the banks didn't make billions in profit back then?

These days, banks don't need deposits to be able to lend money. Central banks provide the liquidity at almost zero interest. In fact, if your bank has too much money on deposit and needs to put it somewhere safe, the Central Bank will actually *charge* them to put it on deposit with them - they get less money back than they put in. That's why you don't get interest on your account any more. The upside? Mortgages at rates of low single percentage points. (My last two mortgages were written before anyone thought EURIBOR could go negative, and one of them almost got to a negative *effective* rate to me!) So no, a bank is not an institution that uses your money and pays you for it - a bank is an institution that stores your money and makes it instantly available to you anywhere in the world, and you pay it for that.

No different than the massive complaints here on HUBB when Flickr or Photobucket started to charge for their services. You want a convenient service? You have to pay for it. No other way.

|

20 Sep 2020

|

|

Contributing Member

HUBB regular

|

|

Join Date: Jul 2019

Location: Ottawa

Posts: 68

|

|

Quote:

Originally Posted by AnTyx

Don't expect to never, ever return to Canada. Even with a POA they might want to see that you're actually alive to start paying out your pension, otherwise the world would be full of mysteriously long-lived but elusive retired Canadians with mysteriously rich lawyers.

You think the banks didn't make billions in profit back then?

These days, banks don't need deposits to be able to lend money. Central banks provide the liquidity at almost zero interest. In fact, if your bank has too much money on deposit and needs to put it somewhere safe, the Central Bank will actually *charge* them to put it on deposit with them - they get less money back than they put in. That's why you don't get interest on your account any more. The upside? Mortgages at rates of low single percentage points. (My last two mortgages were written before anyone thought EURIBOR could go negative, and one of them almost got to a negative *effective* rate to me!) So no, a bank is not an institution that uses your money and pays you for it - a bank is an institution that stores your money and makes it instantly available to you anywhere in the world, and you pay it for that.

No different than the massive complaints here on HUBB when Flickr or Photobucket started to charge for their services. You want a convenient service? You have to pay for it. No other way.

|

Of course - but it doesn't mean I have to like it - not does it not mean that the banks don't use unethical means to make obscene profits, and it doesn't mean I have to like it. I don't. I don't own a house and don't need a mortgage - and how did that work out for millions of Americans during the sub-prime fiasco?

I will do everything in my power to not deal with a large financial institution, but in the end, if I have to I have to. And I am amazed at how many people here are defending modern banking practices when they are sharks sucking the blood of the poor, while wiping the asses of the rich. And then telling me, you have to pay for service....Have you ever bounced a cheque.....the service charge is outrageous....and who does that affect mostly - the poor. And if you are able to maintain a balance of x amount, then your service charges are less....who gets the hit...the poor - and these are only 2 examples....no. **** the banks. And if I can I will.

I still have to look into my pension and may have to return...that remains to be seen. I believe that a lot of this takes place on CRA web site, but I have not tacked that yet.

I also have to work out a way to maintain a legal Canadian address, and have a few options. But still lots to learn.

|

20 Sep 2020

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jan 2016

Location: Tartu, Estonia

Posts: 1,140

|

|

Quote:

Originally Posted by krtw

Have you ever bounced a cheque.....the service charge is outrageous....and who does that affect mostly - the poor.

|

No, I haven't, because instead of being angry that someone does not give me a great service for free, I maintain a reasonable level of financial literacy. Bouncing a cheque is essentially taking out a short-term loan without security and without prior approval - of course that's expensive; just don't try to spend money you don't have in your pocket (account), and you will be fine.

|

20 Sep 2020

|

|

Super Moderator

Veteran HUBBer

|

|

Join Date: Jul 2007

Location: Bellingham, WA, USA

Posts: 4,029

|

|

|

No one here is defending banks or banking practices. You’re setting up straw men then angrily knocking them down, which I doubt serves you well. For starters, we’ve all (or almost all) been reaping the undeniable benefits of everything you complain about—and your trip could easily be described in terms of your determination to continue doing so at the expense of those in the world not positioned to take proper advantage.

All of which might make for an interesting discussion....but it’s unlikely to help you answer the questions you began with, like how to best set up finances for your trip.

Hope that’s helpful.

Mark

|

21 Sep 2020

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Oct 2017

Location: Colombia,(when not travelling)

Posts: 384

|

|

|

Canadian banks are better than they were, which was terrible. I would open an account with an offshore bank (e.g., HSBC expat) if you can, and you will get much better service. Part of the benefit is that they will understand international travel better.

We have 4 accounts in 3 banks, use ATMs for cash, credit cards as much as possible, and carry some cash in USD. IN some parts of the world it's helpful to have local electronic payment applications - for example, M-Pesa in East Africa.

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

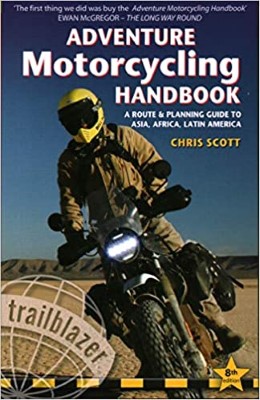

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|