7Likes 7Likes

|

7 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2006

Location: Southampton

Posts: 671

|

|

|

Not helpful

I know this is not necessarily helpful, but I followed the instructions laid out, and sent a letter to the address given with all the relevant info.

I followed this up this week with a phone call to check it had been placed on file, and found there were no notes there, and no record of my letter!

I explained the situation and the woman was adamant that I should EXPORT the vehicle. She was a nice lady and listened to my argument, and said she would double check and ring back. She did and she says that they are 100% sure that this is the way to do it. When we return to the country we just have to contact them to re-inport it.

I didn't have enough knowedge or time to argue and hence we will do this. Not sure if we will pay a price at a later date....

|

7 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: California

Posts: 880

|

|

Quote:

Originally Posted by CornishDeity

I explained the situation and the woman was adamant that I should EXPORT the vehicle. She was a nice lady and listened to my argument, and said she would double check and ring back. She did and she says that they are 100% sure that this is the way to do it. When we return to the country we just have to contact them to re-inport it.

|

That is utter nonsense! You are not 'permanently exporting' the vehicle, just using it away from this country for a while... filling in that paperwork is as bad (actually worse) than not filling it in at all?!

The UK government is hell-bent on gathering statistics and revenue, and paperwork shunting in a desperate attempt to keep the public sector employed...

Just because they don't have the correct tick box for the very few people who are able to travel away from the UK for an extended period, it all goes to sh!t - computer says no...

Personally I agree with what TonyP suggested in the first page - don't ask the DVLA anything! It's only going to cause you more hassle than you need...

xxx

|

7 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2006

Location: West London

Posts: 920

|

|

|

Feckin bureaucrats

Why can't they just make up a story (sorry their minds) and stick to it. It was all looking like there was an easy and quick way to do things in a fashion that satisfied the mindless ones and now this.

Because I've got too much time on my hands I've e-mailed the person who replied to me and Harley to see a) if he's still there and b) what's the story, morning glory.

We'll see what happens.

__________________

Happiness has 125 cc

|

7 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jan 2008

Location: wherever our vehicle is

Posts: 135

|

|

|

sorn

Hey Ollie,

We simply drove out of the country, said nothing, and when we got to Turkey we sent the SORN back to the UK.

Also did the same for our road tax but included a note explaining we were in Turkey and heading East plus asked for the refund cheque to be sent to a family member! No prob's.

When we got back we simply did the usual MOT, got insurance and filled out the SORN form that had come through in the post whilst we were away.

It wasn't an issue BUT that was last summer and things can change.

Hope this helps a little.

Dave

|

8 Apr 2009

|

|

Registered Users

HUBB regular

|

|

Join Date: Jan 2008

Location: On the road, u.k - Australia

Posts: 43

|

|

|

I've been following this with interest but up to now didn't have anything worth posting. I had pretty much decided that I wouldn't bother actually dealing with the DVLA but would just SORN when my tax expired (soon after leaving u.k). However I have just been to get the SORN (V890) form and on it in bold it states 'this form cannot be used if the vehicle is temporarily out of the country'. It looks as though the DVLA have now made it explicit that the way for us to go is not to SORN.

Personally I'm not going to go through the nonsense of permanently exporting the vehicle, and I'm still not sure how effective putting a note on the file they hold will be, so I think I might just ignore the bold print, tax again before I leave to get me legally through Europe, and then SORN from there on. However I can now be sure that this is not really the right thing to be doing.

|

8 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: California

Posts: 880

|

|

|

Typically of this government, anything they can do (legal or not) to get you to keep paying regardless...

You only 'legally' need to pay your road fund licence if you are keeping and/or using the particular vehicle on the road - anything else is just a ruse to get you to keep paying the UK road tax, even if you are not bloody here using it!

As you've suggested, I would simply go ahead with your trip, and just SORN it when the times comes - there is nothing they can do (and they bloody know it, which is why they are desperately trying to confuse us with gobbledy gook).

Like I said above, the DVLA doesn't have a button for the very few of us who travel outside of this country for an extended period - enjoy it while you can, they'll probably think of even more ways to fleece us and restrict out movement at the same time...

This thread is going round and round... I may have to unsubscribe as it is beginning to upset me...

xxx

|

20 Apr 2009

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Mar 2006

Location: West London

Posts: 920

|

|

|

Bugger !!!!!

So like I said I e-mail the DVLA again, specifically the person who contacted myself and Harley and this is the reply I got - see if you can make sense of it, I got a bit lost.

So in the light of this e-mail I'd like to propose a service to all you UK based long-term overlanders. Send the bit off to say you're permanently exporting the vehicle. Send me the V5 and all the bumph. I'll go register your vehicle in France. Then you won't have road tax, the MOT is only every two years and if you go abroad for longer you just MOT it when you get back.

Obviously there's certain costs involved, but hey it's a small price to pay for piece of mind isn't it

Now admire the poor (original) formatting and think, this is where your taxes go......

Thank you for your email.

Firstly I would like to apologise that the advice you have previously received was inaccurate.

I should begin by explaining, since the 1st January 2004, the Continuous Registration legislation became effective. Under this legislation, the registered keeper of a vehicle is legally responsible for ensuring his/her vehicle is currently taxed or a Statutory Off-Road Notification (SORN) has been made at all times. Registered keepers will continue to be responsible for their vehicle until DVLA is notified that the vehicle has been scrapped, sold or exported, or unless a SORN has been made . Please note that as quoted in the Vehicles Registration and Licensing Regulations 2002, a SORN is only valid if the vehicle is kept off road in Great Britain or Northern Ireland.

If a vehicle is taken out of the country (for less than twelve months) but remains registered in Great Britain, the vehicle must be taxed.

If you have a V5C Registration Certificate and are registered as the keeper of the vehicle, you should take the document with you. If you do not have a V5C you should apply for one on V62* application form. The V62 should be returned to DVLA Swansea and will take between 20/30 working days to issue.

However, if you are in possession of the V5C/2 new keepers supplement the DVLA local office may be able to issue a V379/1 temporary Certificate of Registration to cover the period the vehicle is out of the country. The addresses of the DVLA local offices can be found on our website below. If you make your application in person to a Local Office you will also need to provide proof of identity e.g. Passport, Driving Licence or a Utilities Bill, which clearly shows your name and address, and also proof of purchase or Bill of Sale for the vehicle.

If your tax expires and you need to renew it while you are abroad, provided you have a V5C, you may apply for a new tax disc by post using the application V10. The application should be sent to one of the Post Offices® listed in the booklet V100 or to a DVLA local office. The V10 forms are available from the Post Office or can be downloaded from our website. The V100 booklets are available from DVLA or Post Offices. Your application can be made up to six weeks in advance. All applications will require original V5C, or, V5C/2.

However, if the V5/C or the V5C/2 is not available you can submit a V62* application form. Provided you are shown as current keeper on DVLA records or if the previous keeper has notified DVLA of the disposal of the vehicle. You will also need to provide the original Insurance Certificate/Cover Note and MOT Certificate documentation to your Local Office. If you give a despatch address abroad the tax disc of the vehicle can be sent to you there. Remember that it is in your interest to check with your insurer that your use abroad is properly covered. You will also need to fix GB plates on your vehicle to identify the country of registration.

*If you do not have a Registration Document/Certificate there will be a charge for replacement Vehicle Registration Certificates.(£25)

If you are the registered keeper of a vehicle you may also use our website to pay for your tax disc or call our dedicated phone number on 0870 850 4444.

The website address is

www.direct.gov.uk/taxdisc

You can use our website 24 hours per day, 7 days per week*. And within 5 working days of completing your application, you'll receive your tax disc by first class post.

When you retax on the Internet or by telephone we'll electronically check your vehicle is insured on the motor insurance database run by the Motor Insurers Information Centre.

If applicable, we'll also electronically check if your vehicle has a valid new style computerised Test Certificate (MOT/GVT) on the database run by the Vehicle and Operator Services Agency (VOSA)

All you need to do is follow the steps by quoting either the 16 digit reference number on your tax disc application/SORN form V11 or alternatively, you can quote the document reference number on your vehicle registration certificate (V5C)

*subject to essential maintenance.

I should explain, when taxing using our website or telephone service, the tax disc must be issued to the name and address on our records. Therefore, you would need to arrange for a friend or relative to have access to your UK address so the disc may be forwarded to you.

If you are unable to keep the vehicle tax valid whilst outside of the UK I can only advise that you return section 11 of the registration certificate to notify that the vehicle is no longer being kept in the UK. Please note that any tax disc application would be subject to the vehicle having a valid MOT test certificate (UK or northern Ireland only).

DVLA can not advise on what action, if any, may be taken by a foreign authority against an unlicensed UK registered vehicle.

As you can see from my response there is no definitive answer with regards to what should be done if a UK vehicle is kept outside of the UK for over 12 months and is not re-registered.

I trust my reply has been of some assistance.

Regards

Mr I Harris

Motoring : Directgov

[THREAD ID:1-1251GS]

-----Original Message-----

From: alex.richards@xxxxxxxx.fr

Sent: 07/04/2009 15:02:43

To: <vehicles.dvla@gtnet.gov.uk>

Subject: Taking a UK registered vehicle out of the UK for more than 12 months but not permanently registering it in another country.

Hello

I am currently planning a round the world overland trip by motorbike which will be for more than 12 months. I understand that usually this would mean I should send you the V5 document and you would send a Certificate of Permanent Export which is used to register the vehicle in another country.

HOWEVER, I will not be taking up residency in any of the countries I will be passing through and thus wouldn't be permitted to register the motorbike there even if I wanted to. Also I will need to keep the original V5 document intact to present to any border officials in the large number of countries I will be passing through. As you can appreciate a Certificate of Permanent Export would not suffice.

I have heard several different versions of what may or may not be possible and would very much like to clarify the situation. Several months ago I contacted you and received the following: Thank you for your email.

You would not be able to make a SORN declaration with regard to your vehicle because it is out of the country. SORN can only be declared on a vehicle when it is laid up within the confines of the UK.

Because you would not be able to tax your vehicle nor declare it off road let alone permanently export it you would need to write a letter into us. It would be necessary for you to quote the registration number and for you to explain what you intend to do with the vehicle over the next couple of years or so. You can even ask for this correspondence to be placed on the vehicle record so that you are not bothered about any fines or penalties with regard to this vehicle.

The address to write or fax into is;

Vehicle Customer Services, DVLA, Swansea, SA99 1BA.

Fax No. 01792 - 782378.

I hope that this information has clarified matters for you.

Regards

David S Evans

Motoring : Directgov

However a friend did precisely this several days ago and contacted you today to hear that no such notes had been put on file and was told that he should EXPORT the vehicle. Apparently the woman he spoke to was a nice lady and listened to the argument, and said she would double check and ring back. She did and she says that they are 100% sure that this is the way to do it. When he returns to the country he just has to contact them to re-import it.

As I shall shortly be leaving the UK, I'd very much like to verify precisely what I should do, as you can imagine I thought I had this sorted out, but it now appears I may have to do something entirely different. Also to have a definative reply would be very useful as I know of numerous people who have asked the same thing on several overland travellers' websites. Perhaps if some log could be made on your system and either a definative answer posted on your website, and also if possible a hard copy of the reply which could be distributed to the relevant motoring associations (only two after all).

Yours

Alex Richards

__________________

Happiness has 125 cc

|

|

Currently Active Users Viewing This Thread: 3 (0 Registered Users and/or Members and 3 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

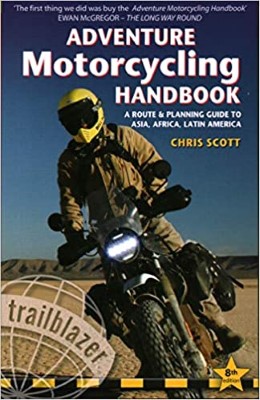

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|