9Likes 9Likes

|

|

20 May 2023

|

|

Registered Users

New on the HUBB

|

|

Join Date: May 2023

Posts: 2

|

|

I use Wise. Very simple, no additional fees, and you even get a percentage of the amount of money you have on your account. They're awesome, to be honest.

N26 / Bunq is also a great alternative. techwear-division.com

Last edited by krakenn; 16 Jun 2023 at 02:22.

|

20 May 2023

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jul 2011

Location: Somewhere

Posts: 1,501

|

|

Quote:

Originally Posted by poldark

Same here, though no need to use an ATM unless you need to hold cash, pay with the Wise card and as well as excellent exchange rate & no additional fees (at least on UK based accounts) you get 1% cashback too - it all adds up.

Sent from my motorola one using Tapatalk

|

All well and good until you travel in a country where places accepting cards are limited or rare and most transactions are cash.

|

20 May 2023

|

|

Registered Users

New on the HUBB

|

|

Join Date: Jan 2021

Posts: 5

|

|

Quote:

Originally Posted by TheWarden

All well and good until you travel in a country where places accepting cards are limited or rare and most transactions are cash.

|

Where you can use it in the ATM to draw out local currency ....

Sent from my motorola one using Tapatalk

|

20 May 2023

|

|

Super Moderator

Veteran HUBBer

|

|

Join Date: Jul 2007

Location: Bellingham, WA, USA

Posts: 4,015

|

|

Quote:

Originally Posted by poldark

Where you can use it in the ATM to draw out local currency ....

|

When I look at the terms for this card, it appears I'd be limited to a couple of hundred US$ withdrawals per month. That's not much of a backup plan for travel in areas where plastic cards are seldom accepted. Am I missing something?

|

21 May 2023

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Dec 2019

Location: BKI, Sabah

Posts: 459

|

|

@markhaf,

For my Malaysian Wise card, there are no restrictions on cash withdrawal. The caveat is that only 2 transactions and limited to a certain amount are free.

Thereafter, you can withdraw whenever you like but you have to pay a fee.

The Wise card is also easy to send funds to someone to their local bank account . I paid for my bike rentals in Chiang Mai and Hanoi using Wise by transferring the amount to their local bank account. They receive the funds within a few minutes.

I wanted to pay for the bike rental in Angeles City, Philippines using Wise but the bike rental shop owner was fussy so I just used cash.

That way, I don't have to carry a huge amount of cash for the bike rental with me.

|

21 May 2023

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Jan 2002

Location: Toronto, Canada

Posts: 2,134

|

|

Quote:

Originally Posted by markharf

When I look at the terms for this card, it appears I'd be limited to a couple of hundred US$ withdrawals per month. That's not much of a backup plan for travel in areas where plastic cards are seldom accepted. Am I missing something?

|

Mark:

I don't know if you are referring to a specific brand of card, such as the 'Wise' card that keeps popping up in this discussion, or debit cards in general.

I don't know anything about Wise cards and had never heard of them until reading this discussion.

So far as debit cards in general go (cards issued by your home bank that you can use to make ATM withdrawals), the limit on the amount of money you can withdraw in any one day is set by your home bank. So talk to your home bank and have them establish a daily limit that meets your needs.

Before I retired, it was common for me to be in up to 60 different countries a year, and 5 to 7 countries in any one week - I delivered new aircraft from the factory to customers all over the world. I never once had a problem withdrawing cash from an ATM in any country, and I visited a lot of hole-in-the-wall Third World countries.

I had a daily withdrawal limit equal to CAD $5,000 (about USD $4,000, €4,000). I needed it this high because I occasionally had to pull out large amounts of cash to handle government fees that I would get surprised with along the way. In some locations, I found that individual ATMs would limit my daily withdrawals to about $1,000, but if I went to a different bank ATM, I could continue to make withdrawals up to my daily limit.

TL;DR: Make arrangements with your local bank - the bank that issued your ATM card - to have the daily withdrawal limit set to an amount that meets your needs.

|

21 May 2023

|

|

Super Moderator

Veteran HUBBer

|

|

Join Date: Jul 2007

Location: Bellingham, WA, USA

Posts: 4,015

|

|

Quote:

Originally Posted by 9w6vx

@markhaf,

For my Malaysian Wise card, there are no restrictions on cash withdrawal. The caveat is that only 2 transactions and limited to a certain amount are free.

Thereafter, you can withdraw whenever you like but you have to pay a fee.

|

Ah, I see that's the way it works from the US, too. I'll have to run some numbers and consider some hypotheticals to find out when it might be worthwhile.

Quote:

Originally Posted by PanEuropean

Mark:

I don't know if you are referring to a specific brand of card, such as the 'Wise' card that keeps popping up in this discussion, or debit cards in general.

I don't know anything about Wise cards and had never heard of them until reading this discussion.

|

I was referring to the Wise card, which I'd never heard of either. It appears there are some advantages, but I'm not (yet) convinced it would be worth dealing with another option after credit and debit cards.

Quote:

Originally Posted by PanEuropean

TL;DR: Make arrangements with your local bank - the bank that issued your ATM card - to have the daily withdrawal limit set to an amount that meets your needs.

|

Funny that it never occurred to me to talk to my debit card banks about this. Can't hurt (in the absence of an express kidnapping), and would certainly be handy at times.

Mark

|

21 May 2023

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Jan 2002

Location: Toronto, Canada

Posts: 2,134

|

|

Quote:

Originally Posted by markharf

Can't hurt (in the absence of an express kidnapping), and would certainly be handy at times.

|

Although you wrote that line in jest (I assume), it is something that is worth thinking about.

After I retired, I had the bank lower the daily maximum withdrawal limit on my card to CAD $500 (about USD 400, Euro 400) because I no longer have any need to withdraw more than that each day, and there is no point in having such a high daily limit.

I'm not too concerned about kidnapping, more about card-cloning and the risk of someone shoulder-surfing my PIN.

Michael

|

21 May 2023

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2006

Location: California

Posts: 880

|

|

|

In summary - any card which uses the VISA network, ought to work in any other country for ATM withdrawals and purchases, but as has been suggested: if you are planning on using your domestic card abroad, then inform your bank of the countries you intend to visit and also agree a daily limit (this is so the bank doesn't automatically freeze your card thinking it may have been cloned and is being used abroad). Note that if you bank online, then typically any pre-agreed card limit can be changed or even the card frozen if required (were it lost or stolen for example) while you're travelling.

However, if you're going away for an extended period, it makes sense to have a 'dedicated' travel account (not debiting from your main personal domestic account, which if hacked/cloned or the card stolen, could lead to a lot of further financial headaches you don't need!) - either a second card/account with your domestic bank, or with one of the third party international 'banks' like Wise, who - as has been pointed out - differ fundamentally in that they are not actually making international transfers in the tradition sense, rather they hold the credited/deposited amount of money in their own account in the respective country, and allow their users to draw on those funds as if they were a domestic customer, based on the overall deposit balance you made with them initially. While there is a modest percentage cost/charge for their service, it avoids all the other transaction fees - which is why Wise is also a good option if you have move/spend larger amounts of money in a different country to your own - for example purchasing a vehicle, or paying a large bill of some other kind.

Personally I do not have a Wise [debit/credit] card, as I'm not travelling so much between lots of different countries/currencies anyway these days, but have certainly used them in the past for transferring larger amounts of money between bank accounts in respective countries.

Jx

|

21 May 2023

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jul 2011

Location: Somewhere

Posts: 1,501

|

|

Quote:

Originally Posted by PanEuropean

So far as debit cards in general go (cards issued by your home bank that you can use to make ATM withdrawals), the limit on the amount of money you can withdraw in any one day is set by your home bank. So talk to your home bank and have them establish a daily limit that meets your needs.

.

|

In Morocco the daily withdrawal limit is set by the local bank at 2000dH. Sometimes if you are fast you can get another withdrawal the same day.

The general gist of this discussion is you need to be aware of what your bank charges for foreign transactions, either at an atm or using the card. There are cheaper alternatives but many limit how many cheap transactions or cash withdrawals you get per month. There are also some like Starling that have no limit.

|

21 May 2023

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Jan 2002

Location: Toronto, Canada

Posts: 2,134

|

|

Quote:

Originally Posted by TheWarden

In Morocco the daily withdrawal limit is set by the local bank at 2000dH.

|

The solution to that problem is to go to a different bank (different brand of bank) and withdraw another 2,000 dH from the different bank. I've done that before.

Quote:

Originally Posted by JMo (& piglet)

...any card which uses the VISA network, ought to work in any other country for ATM withdrawals and purchases

|

To be more precise, the two most common "network names" (card alliance names for ATM withdrawals) are 'Cirrus' and 'Maestro'. Check on the back of your home bank card and you will likely see one or both of those network logos on the back of the card. That indicates that the card will work at all ATMs within that network.

Michael

|

21 May 2023

|

|

Super Moderator

Veteran HUBBer

|

|

Join Date: Jul 2007

Location: Bellingham, WA, USA

Posts: 4,015

|

|

Quote:

Originally Posted by JMo (& piglet)

In summary - any card which uses the VISA network, ought to work in any other country for ATM withdrawals....

|

As Michael points out, it's not the VISA affiliation, but rather mostly Cirrus or Maestro which matters for ATM withdrawals. I'll admit total ignorance about the other logos I see on some of my debit cards--Moneypass, NYCE, Plus, Co-Op, Pulse.

And because this is an international group, it's worth staying aware of whole countries where our cards will not work--Russia and North Korea, obviously, but depending on your country of origin the list might expand to include parts of Sudan, Syria, Cuba, Iran, Donetsk and Crimea, and lots more. Specific banks sometimes blacklist extensively--I saw one US bank which lists over 50 countries in which your credit/debit transactions would be refused. Then there are countries where it's sometimes difficult to find banks which accept foreign cards--Brazil is notable, but again there are lots of others in different degrees.

All of which makes it difficult to offer simple answers to the OP's question, which was some version of "What banks and credit cards do you use when traveling internationally?" The major miracle is that the handful of cards I have in my desk drawer will carry me almost anywhere I want to go, with just a few exceptions which are largely quite predictable. And when the system doesn't serve me (using an non-chipped American card to try and buy gasoline or a train ticket in France 10 or 12 years ago, or violating the so-called "Trading with the Enemy Act" a few years after that), there are usually loopholes available for the persistent.

|

22 May 2023

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Jan 2002

Location: Toronto, Canada

Posts: 2,134

|

|

Quote:

Originally Posted by markharf

...t's worth staying aware of whole countries where our cards will not work--Russia and North Korea, obviously, but depending on your country of origin the list might expand to include parts of Sudan, Syria, Cuba, Iran, Donetsk and Crimea, and lots more.

|

Prior to the start of the Russia-Ukraine conflict, the list of countries where you could not use foreign cards to make ATM withdrawals was pretty short: Sudan and North Korea were the only two that I was aware of.

Since the beginning of the Russia-Ukraine conflict, the list has expanded quite a bit, in almost all cases as a result of sanctions imposed by the US Government (to be specific, the US Department of the Treasury). Because the ATM networks (Cirrus & Maestro) have a significant presence in America, they are obliged to comply with US sanctions. This affects everyone worldwide - doesn't matter if your card is issued by a Canadian or European bank, if the Americans have imposed sanctions, you won't be able to access Cirrus & Maestro services in the sanctioned countries.

Venezuela might also be on the sanctions list, not because of any conflict but because the Americans are pissed off at Venezuela.

You can get a better idea of what countries are being sanctioned by looking at the US Department of the Treasury website.

Quote:

Originally Posted by markharf

...I saw one US bank which lists over 50 countries in which your credit/debit transactions would be refused.

|

That might just be a choice made by a specific US bank because they don't want to have to deal with the risk of fraudulent transactions from those countries - not unlike, for example, the eBay & Amazon sellers who decline to sell or ship anything to a long list of countries (Nigeria comes to mind) because they have had too many fraud problems originating in those countries in the past. It's not a sanctions issue.

Michael

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

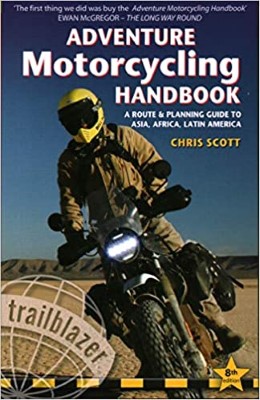

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|