3Likes 3Likes

-

1

Post By Two wheels good

1

Post By Two wheels good

-

1

Post By Two wheels good

1

Post By Two wheels good

-

1

Post By Two wheels good

1

Post By Two wheels good

|

17 Oct 2017

|

|

Registered Users

HUBB regular

|

|

Join Date: Sep 2017

Location: Esperance, Western Australia

Posts: 92

|

|

|

Buying a tax-free bike in UK

Hi to you all. I am starting to plan a ride from London to Cape Town in a year or so's time.

I'm considering buying a new bike in the UK on the VAT (purchase tax) free scheme and eventually exporting it at the end of the ride back home to Australia.

Has anyone any experience of whether the fact that the bike is purchased free of tax has any bearing on the international carnet system?

Or anything else for that matter.

I know that when I import it into Aus I will have to pay customs charges and probably some tax as well, that isn't what I am asking about, just the journey.

Thanks in advance, Al.

|

17 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: East Sussex, England

Posts: 174

|

|

|

I've no direct experience of what you plan but ..

Won't the bike have to be registered before getting the carnet? Registration will require VAT\sales tax\excise duty to be paid - whatever country you choose.

Maybe a prince has diplomatic immunity?

|

18 Oct 2017

|

|

Registered Users

HUBB regular

|

|

Join Date: Sep 2017

Location: Esperance, Western Australia

Posts: 92

|

|

|

Yes, I do have diplomatic immunity by virtue of my regal status, kneel and pay homage, O lowly one.

When you buy tax free in UK, the bike is registered on export plates.

Last time I did it (1995), I exported the bike to USA which is more relaxed on carnets.

This time, it's going to be ridden through Africa, and, who knows?, maybe S America.

|

18 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: East Sussex, England

Posts: 174

|

|

|

Interesting ... I didn't know export plates were an aspect of the UK registration system. Best of luck with your plans.

Yours, tugging my forelock and in envious admiration of royalty's skill at avoiding taxes.

|

18 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2006

Location: Bribie Island Australia

Posts: 678

|

|

|

With all the faffing around with countries that have annual roadworthy inspections and registration, I reckon you'd be better taking a bike from Australia where in most States you only need an internet connection to renew/pay another year's rego. Just do the trip in reverse. That resolves all the "will I get an import approval" when the bike comes back into Australia.

I thought Germany was the only country in the EU that had export plates with one year registration and green card insurance, I used that back in 2007 for a campervan, so not exactly up to date. There were some conditions as well - cant re enter Germany.

The UK's export scheme is a nightmare if I remember correctly, you can only get the VAT back if the seller is VAT registered, the vehicle documents have to show its been permanently exported - so has to be de-registered - so no valid carnet......................plus you don't know if you'll get your VAT back until you have left the country, then you have to have a UK bank account for the refund to be transferred into. Nightmare when I was looking at it.

Now where's my guillotine for the aristos..........

|

19 Oct 2017

|

|

Registered Users

HUBB regular

|

|

Join Date: Sep 2017

Location: Esperance, Western Australia

Posts: 92

|

|

|

Thanks RogerM. The tax free scheme for overseas visitors in UK only works for new vehicles to the best of my knowledge. You don't get a refund, you simply don't pay the tax in the first place. Take your point about de-registration though. I had considered doing the trip in reverse, taking a bike from Aus and going CapeTown to London, but tax free purchase isn't an option in Aus as far as I know.

Maybe I'll just bend over, take it like a man and buy tax-paid in UK for an easy life!

|

19 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: East Sussex, England

Posts: 174

|

|

|

Buying an ex-demo or nearly new bike from a dealer should give you significant savings. I've often heard that the first year's depreciation is roughly similar to the VAT levied on the new price. I haven't had the luxury of testing that theory myself.

If you decide to finish the trip in UK and have a useable 650 single for sale I'd be interested to hear from you. That plan almost worked for me 10 month ago but the AUS bike broke down in Germany.

|

23 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Oct 2016

Location: Devon, UK

Posts: 872

|

|

I'd be interested to see any link to this tax free scheme, and I guess a few others would too. Though I must say it sounds too good to be true, and you know what they say about that

Where I suspect it may fall over is that if it's designed for bikes that are being exported to another country (you can reclaim VAT on personal permanent exports) there may be no provision for them to be used before they are re-registered elsewhere. To ride a bike in the UK it must be legal in its home country (same principle applies all over Europe) and if the home country (state of sale/registration) then I'd have thought all domestic taxes would have to be paid in order to obtain a registration number which is needed for insurance and road tax. Happy to be proved wrong.

|

23 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2006

Location: Bribie Island Australia

Posts: 678

|

|

|

BMW used to run a ride/export scheme from Germany, they would export the bike for you in one of their regular shipments after you'd run up 50,000kms on it. I think Guzzi also did the same. Not sure when they stopped, or maybe they haven't. Probably worth an email or two.

|

24 Oct 2017

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Jul 2005

Location: Wirral, England.

Posts: 5,679

|

|

|

Buy a nearly new bike.

The VAT will have already been paid (and lost) by the first owner.

If you buy a used bike from a BMW dealer, then you will get a two year World wide warranty and European recovery included in the purchase price.

__________________

Did some trips.

Rode some bikes.

Fix them for a living.

Can't say anymore.

|

24 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: East Sussex, England

Posts: 174

|

|

I don't doubt that such schemes exist and I was curious enough to investigate. I know uk.gov websites are usually very clear.

Here are two relevant pages for two different schemes:

1) taking-vehicles-out-of-uk

"If you buy a brand new vehicle to take out of the UK (also known as supply of a ‘New Means of Transport’) you don’t have to pay UK VAT or vehicle taxes such as the registration fee."

(Interestingly this can apply to a new vehicle going to the EU too. But that obviously isn't relevant in this case.)

2) Personal Export Scheme This seems to be the most suitable

Extract:

"This notice describes the Personal Export Scheme (PES). The scheme allows motor vehicles to be supplied in the United Kingdom free of VAT if they’ll soon be exported to a destination outside the EU. This notice sets out the conditions you must follow if you want to use the scheme, either as a buyer or a seller.

Who can use this scheme

You can use the scheme if you’re:

from outside the EU

an EU resident who’s leaving the EU for at least 6 months

You usually have to be personally driving your vehicle to a non-EU country."

That last sentance would suggest the vehicle is registered and road legal. The page also says the owner can use it for 12 months in the UK. That's a surprise!

|

26 Oct 2017

|

|

Registered Users

HUBB regular

|

|

Join Date: Sep 2017

Location: Esperance, Western Australia

Posts: 92

|

|

|

Too good to be true?

Quote:

Originally Posted by Des Senior

I'd be interested to see any link to this tax free scheme, and I guess a few others would too. Though I must say it sounds too good to be true, and you know what they say about that

Where I suspect it may fall over is that if it's designed for bikes that are being exported to another country (you can reclaim VAT on personal permanent exports) there may be no provision for them to be used before they are re-registered elsewhere. To ride a bike in the UK it must be legal in its home country (same principle applies all over Europe) and if the home country (state of sale/registration) then I'd have thought all domestic taxes would have to be paid in order to obtain a registration number which is needed for insurance and road tax. Happy to be proved wrong. |

Understand your cynicism, Des Senior.

Google VAT notice 707: Personal Export Scheme for further info.

I bought a bike under this scheme in 1995, rode it around the UK quite legally for a few months then shipped it to USA for what was going to be a long holiday prior to shipping it onwards to it's final destination in NZ, to where I was emigrating.

After spending some three months in USA, I concluded I was too idle to arrange shipping and sold it to a dealer for basically the same price I had paid tax-free in UK.

It's a legit scheme.

|

26 Oct 2017

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Aug 2012

Location: Australia

Posts: 1,131

|

|

Quote:

Originally Posted by RogerM

BMW used to run a ride/export scheme from Germany, they would export the bike for you in one of their regular shipments after you'd run up 50,000kms on it. I think Guzzi also did the same. Not sure when they stopped, or maybe they haven't. Probably worth an email or two.

|

BM stopped that many years ago.

They may have started again?

Moto Guzzie .. don't know, they used to run it, but now?

Contact the local dealer? Might be possible for other Euro makes.

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

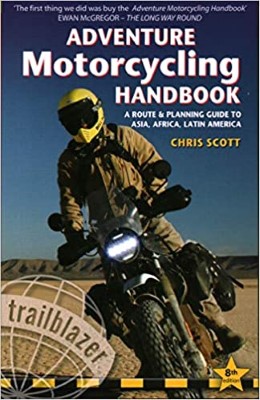

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|

3Likes

3Likes

3Likes

3Likes